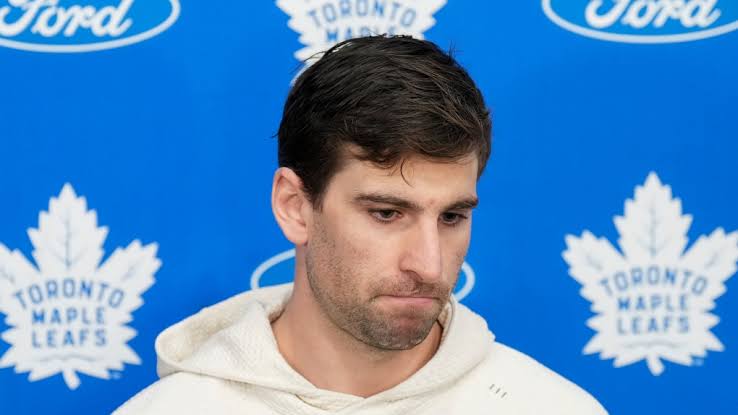

Professional athletes in the United States and Canada may be impacted by the John Tavares tax lawsuit.

The John Tavares tax lawsuit could have significant implications for professional athletes in the United States and Canada. Tavares, a prominent NHL player, has been involved in legal disputes over tax obligations related to his income. While the specifics of the lawsuit are complex, its outcomes could set precedents affecting how athletes handle their taxes.

In the U.S. and Canada, athletes often face complicated tax scenarios due to the nature of their earnings, which can include multi-state or multi-provincial sources, endorsements, and international income. The lawsuit highlights issues related to tax jurisdiction and residency, potentially affecting how and where athletes are taxed on their earnings.

For athletes, this case could lead to increased scrutiny from tax authorities and necessitate more sophisticated tax planning. They might need to reassess their financial strategies to ensure compliance and optimize their tax positions. Additionally, the lawsuit underscores the importance of legal and financial advice tailored to the unique needs of professional athletes, who often operate across multiple tax jurisdictions.

Overall, the John Tavares tax case serves as a reminder of the complex tax landscape professional athletes navigate and may prompt changes in how tax regulations are applied or interpreted in the future.